Hydrogen peroxide is an environmentally friendly, deodorizing, and bleaching agent. The wide range of hydrogen peroxide applications includes chemical processing, textile and pulp bleaching, metal treating, cosmetic applications, waste treatment, and catalysis of reactions. The hydrogen peroxide industry spans throughout the world, with a total production of 4.6 million tonnes in the year 2018.

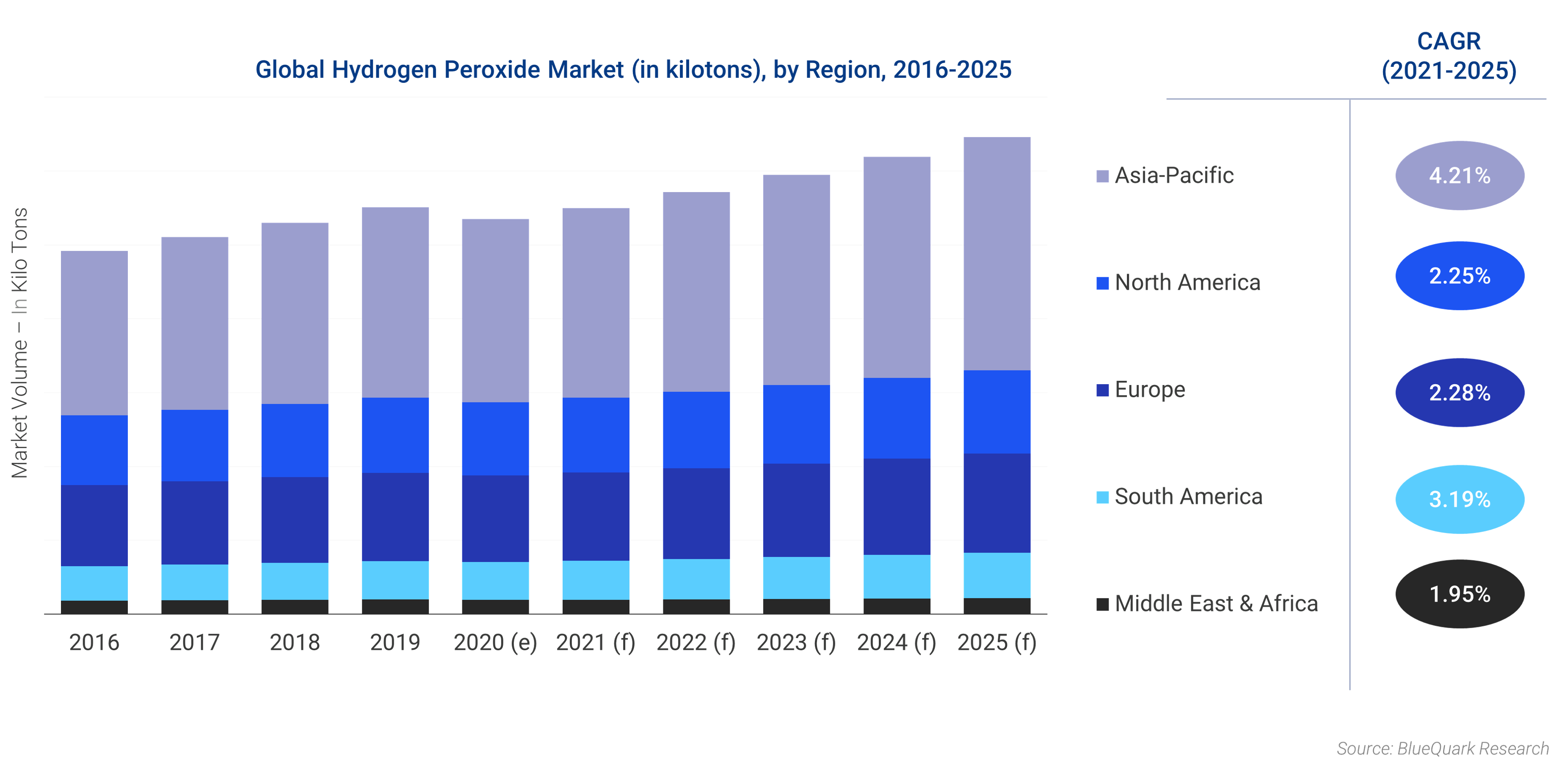

According to BlueQuark Research, the Hydrogen Peroxide market is estimated to record at a CAGR of 3.27% during the forecast period. The major factors responsible for the growth of the global hydrogen peroxide market are the extensive usage of hydrogen peroxide in the pulp & paper industry, the growing demand for hydrogen peroxide to propylene oxide (HPPO) process for propylene oxide manufacturing, and the increased use of hydrogen peroxide in water treatment. More than two-thirds of the hydrogen peroxide produced in the United States and Canada is used by the pulp and paper industry to bleach wood pulp prior to making paper. The reason for this is lower production costs, improved paper quality, increased yield of wood mass as well as ecological efforts to remove chlorine compounds in pulp bleaching processes, and their replacement with environmentally friendly bleach products. Approximately more than 50% of all hydrogen peroxide produced worldwide is used as an agent in the bleaching of both mechanical and chemical pulps, supporting elemental chlorine-free bleaching. In many mills, there is a need to disinfect the water system to prevent microbial contamination of fibrous material in the circulation of water. Polysaccharides, which are leached from the pulp, act as nutrients for microbial growth and result in formations of microbial or semi-chemical slimes. These cause critical failures in papermaking and a reduction in the quality of paper, resulting in overall losses.

The uncontrolled growth of slimes can ultimately cause the breakages of paper and, as a consequence, a stoppage of the production line. Solutions of peracetic acid, which is a mixture of peracetic acid, hydrogen peroxide, acetic acid, and water that is available in various grades have been proved to be an effective bio-film remover in the water systems and are used as an environmentally benign oxidizing biocide in the pulp & paper industry. At present, the population growth and a general rise in the global standard of living have resulted in a surge in the use of hygienic paper goods such as diapers and tissue paper. There is also a rising demand for paper and board for packaging, fueled largely by the soaring e-commerce industry and a change in food consumption habits. Hydrogen Peroxide is an effective disinfectant to use against SARS-COV-2 that persists on inanimate surfaces and surroundings. A good broad spectrum of bactericidal and antiviral properties combined with excellent stability and environmentally friendly characteristics make hydrogen peroxide an ideal disinfectant for virus inactivation.

High purity grade (>85%) hydrogen peroxide is largely used in aeronautics & space (propulsion applications) and electronics applications. And it is one of the most attractive replacements, not only since it is non-toxic and non-carcinogenic, but also due to its many advantageous properties, such as its high density and relatively low cost. Hydrogen peroxide is a mainstay in surface treatment within the metals and electronics industry. It is used for etching, polishing, and cleaning, plus it eliminates nitrogen oxide gases (NOx) in connection with nitric acid-based pickling operations.

The production and consumption of Hydrogen Peroxide are highest in Asia due to the increased usage of hydrogen peroxide as a bleaching agent in the pulp & paper industry. China leads the world in the production and consumption of paper, with the United States coming closely behind. China is the largest paper-producing country in the world, with an annual paper production of around 130 million tons in 2019. China's pulp & paper industry is flourishing at a rapid pace due to continuous investments by domestic as well as international players in the region. China accounts for more than a quarter of the global paper, tissue paper, and paper board production. China under its 13th 5-year plan made guidelines include; Implement innovative development strategy to accelerate the transition of the paper industry to high-tech and high-value-added direction; Further, promote industry integration, make full use of domestic and overseas resources, and improve the structure of raw materials.; Promote resource recycling, strengthen cleaner production, focus on energy saving and emission reduction, advocate green and low carbon consumption.

Evonik Industries AG along with Thyssenkrupp is the developer of the hydrogen peroxide to propylene oxide (HPPO) technology. HPPO process is an eco-friendly and cost-efficient direct method for the production of propylene oxide that is mainly used to produce polyurethane precursors. Polyurethane is used in a broad range of applications due to its versatile properties such as flexibility, electrical properties, resistance to harsh environmental conditions, and economical manufacturing process among others. In the HPPO process hydrogen peroxide is used as an oxidizing agent, and the by-product is the only water that makes it an eco-friendly process compared to other processes such as the chlorohydrin process and the hydroperoxide process. Propylene oxide is a major industrial product with a worldwide production of more than 10 million tons per year. Around 70% of the total production is used for polyether polyols that are in turn used as raw materials for polyurethanes. Polyurethanes are a diverse class of polymers representing nearly 6% of the overall global polymer market with applications that include coatings, adhesives, foams, elastomers, among others. Buildings insulated with polyurethanes save over 70 times more energy during their lifecycle than was needed to manufacture the polyurethanes in the first place. According to European Diisocyanate and Polyol Producers Association, approximately 50 million kWh of energy is saved yearly in the European Union by using polyurethane insulation materials alone.

On the basis of geography, the global hydrogen peroxide market analysis report is segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is expected to be the fastest-growing region due to the continuous increase in environmental degradation and technological advancements. The US pulp and paper industry is on the cutting edge of science and technology. It is the second-largest producer of pulp & paper in the world. About 28% of the trees harvested in the US are used to produce wood pulp for making paper and paperboard.

The hydrogen peroxide global market is segmented on the basis of grade and end user industry. The end user industry segment is further segmented as Pulp & Paper, Textile & Laundry, Aeronautics & Space, Chemical Synthesis, Cosmetic & Personal Care, Environmental Applications, and Others. Hydrogen peroxide consumption in the pulp and paper industry has significantly increased in the past 20 years due to its low production cost and eco-friendliness. Hydrogen peroxide improves the paper quality and yield of wood mass and is more environmentally friendly than chlorine compounds. Hydrogen peroxide is responsible for more than 50% of the pulp & paper bleaching.

Some of the key players in the market are Evonik Industries AG, Solvay S.A., National Peroxide Limited, Arkema Group, Mitsubishi Gas Chemical Company Inc., and Aditya Birla Chemicals Ltd. Solvay was found to be the leading player in the Global Hydrogen Peroxide market followed by Evonik Industries, Mitsubishi Chemical Company Inc., and Arkema Group among others.

Our Global Hydrogen Peroxide Market report provides deep insight into the Hydrogen Peroxide market's current and future state across various regions. The study comprehensively analyzes the Hydrogen Peroxide market by segmenting based on grades (Industrial Hydrogen Peroxide, High Grade, Lab Grade, Food Grade, and Others), End-Users (Pulp & Paper, Textile & Laundry, Aeronautics & Space, Chemical Synthesis, Cosmetic & Personal Care, Environmental Applications and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report examines the hydrogen peroxide market size, market forecast, market drivers and restraints, and the impact of Covid-19 on the market growth in detail. The study covers & includes hydrogen peroxide market analysis, emerging market trends, developments, opportunities, growth rate, and challenges in the industry. This report also covers extensively researched competitive landscape sections with prominent companies' profiles, including their market shares and projects.

Global Hydrogen Peroxide Market Size, in kilotons, 2016-2026

Food Grade - Global Hydrogen Peroxide Market Size, in kilotons, 2016-2026

Technical Grade - Global Hydrogen Peroxide Market Size, in kilotons, 2016-2026

Lab Grade - Global Hydrogen Peroxide Market, in kilotons Size, 2016-2026

Industrial Grade - Global Hydrogen Peroxide Market, in kilotons Size, 2016-2026

Others Grades - Global Hydrogen Peroxide Market, in kilotons Size, 2016-2026

Pulp & Paper - Global Hydrogen Peroxide Market, in kilotons Size, 2016-2026

Textile & Laundry - Global Hydrogen Peroxide Market, in kilotons Size, 2016-2026

Click Here for more Tables & Charts

Aeronautics & Space - Global Hydrogen Peroxide Market, in kilotons Size, 2016-2026

Chemical Synthesis - Global Hydrogen Peroxide Market, in kilotons Size, 2016-2026

Cosmetics & Personal Care - Global Hydrogen Peroxide Market Size, in kilotons, 2016-2026

Environmental Applications - Global Hydrogen Peroxide Market Size, in kilotons, 2016-2026

Others Applications - Global Hydrogen Peroxide Market Size, in kilotons, 2016-2026

Global Hydrogen Peroxide Market Size, in USD million, 2016-2026

North America Hydrogen Peroxide Market Size, in USD million, 2016-2026

United States Hydrogen Peroxide Market Size, in USD million, 2016-2026

Canada Hydrogen Peroxide Market Size, in USD million, 2016-2026

Mexico Hydrogen Peroxide Market Size, in USD million, 2016-2026

Europe Hydrogen Peroxide Market Size, in USD million, 2016-2026

United Kingdom Hydrogen Peroxide Market Size, in USD million, 2016-2026

Germany Hydrogen Peroxide Market Size, in USD million, 2016-2026

Italy Hydrogen Peroxide Market Size, in USD million, 2016-2026

France Hydrogen Peroxide Market Size, in USD million, 2016-2026

Russia Hydrogen Peroxide Market Size, in USD million, 2016-2026

Nordic Countries Hydrogen Peroxide Market Size, in USD million, 2016-2026

Rest of Europe Hydrogen Peroxide Market Size, in USD million, 2016-2026

South America Hydrogen Peroxide Market Size, in USD million, 2016-2026

Brazil Hydrogen Peroxide Market Size, in USD million, 2016-2026

Argentina Hydrogen Peroxide Market Size, in USD million, 2016-2026

Rest of South America Hydrogen Peroxide Market Size, in USD million, 2016-2026

Asia-Pacific Hydrogen Peroxide Market Size, in USD million, 2016-2026

China Hydrogen Peroxide Market Size, in USD million, 2016-2026

India Hydrogen Peroxide Market Size, in USD million, 2016-2026

Japan Hydrogen Peroxide Market Size, in USD million, 2016-2026

South Korea Hydrogen Peroxide Market Size, in USD million, 2016-2026

ASEAN Countries Hydrogen Peroxide Market Size, in USD million, 2016-2026

Rest of Asia-Pacific Hydrogen Peroxide Market Size, in USD million, 2016-2026

Midde East & Africa Hydrogen Peroxide Market Size, in USD million, 2016-2026

Saudi Arabia Hydrogen Peroxide Market Size, in USD million, 2016-2026

South Africa Hydrogen Peroxide Market Size, in USD million, 2016-2026

Rest of Middle-East & Africa Hydrogen Peroxide Market Size, in USD million, 2016-2026

Hydrogen Peroxide Market price

Hydrogen Peroxide Market Trends

Hydrogen Peroxide - Market Share of Key Companies in 2018

Paper production & consumption trend

Hydrogen peroxide production trend

Report - Global Hydrogen Peroxide Market Outlook to 2027.pdf

Report - Global Hydrogen Peroxide Market Outlook to 2027.pdf Market Data - Global Hydrogen Peroxide Market Outlook to 2027.xls

Market Data - Global Hydrogen Peroxide Market Outlook to 2027.xls